Estate Planning Attorney for Beginners

Estate Planning Attorney for Beginners

Blog Article

6 Easy Facts About Estate Planning Attorney Described

Table of ContentsGetting My Estate Planning Attorney To WorkNot known Details About Estate Planning Attorney Not known Details About Estate Planning Attorney All about Estate Planning AttorneyThe 15-Second Trick For Estate Planning Attorney

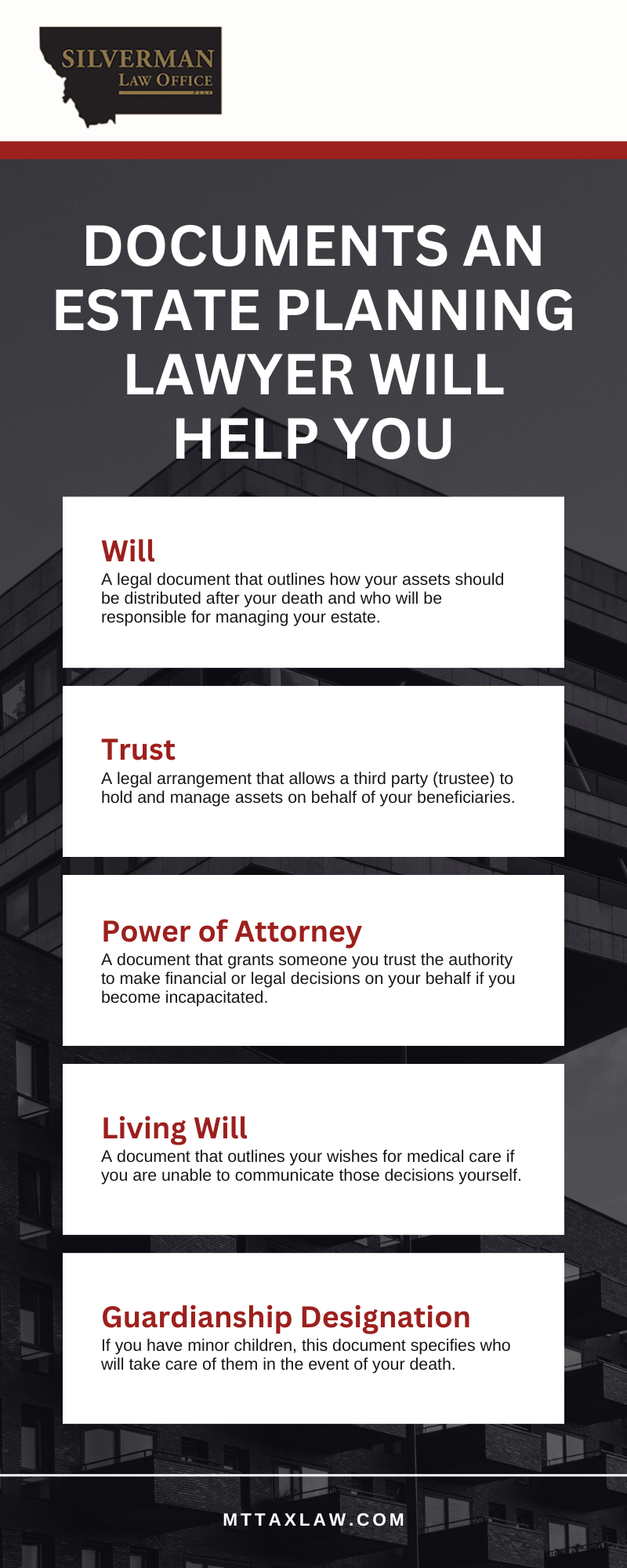

Encountering end-of-life choices and safeguarding household riches is a difficult experience for all. In these difficult times, estate preparation attorneys help individuals prepare for the circulation of their estate and develop a will, count on, and power of lawyer. Estate Planning Attorney. These attorneys, also described as estate law lawyers or probate attorneys are qualified, experienced specialists with a thorough understanding of the federal and state regulations that relate to how estates are inventoried, valued, dispersed, and strained after death

The intent of estate planning is to correctly get ready for the future while you're sound and capable. An effectively ready estate strategy outlines your last dreams specifically as you desire them, in the most tax-advantageous way, to prevent any questions, misunderstandings, misconceptions, or disagreements after fatality. Estate planning is a field of expertise in the lawful profession.

See This Report about Estate Planning Attorney

These lawyers have a thorough understanding of the state and federal regulations associated with wills and trusts and the probate procedure. The obligations and obligations of the estate lawyer may consist of counseling customers and drafting lawful files for living wills, living counts on, estate plans, and estate taxes. If required, an estate preparation attorney may get involved in lawsuits in probate court on part of their clients.

According to the Bureau of Labor Statistics, the employment of lawyers is expected to grow 9% in between 2020 and 2030. About 46,000 openings for attorneys are predicted each year, generally, over the decade. The path to becoming an estate planning attorney resembles other practice areas. To enter law college, you must have a bachelor's degree and a high grade point average.

When possible, think about possibilities to acquire real-world work experience with mentorships or teaching fellowships associated with estate planning. Doing so will provide you the abilities and experience to gain admittance into legislation institution and connect with others. The Legislation College Admissions Test, or LSAT, is an essential component of using to legislation institution.

It's important to prepare for the LSAT. Many law students apply for law school throughout the loss semester of the final year of their undergraduate research studies.

Estate Planning Attorney Things To Know Before You Get This

Typically, the annual wage for an estate attorney in the united state is $97,498. Estate Planning Attorney. On the high end, an estate preparation attorney's wage may be $153,000, according to ZipRecruiter. The estimates from Glassdoor are comparable. Estate planning attorneys can function at large or mid-sized law practice or branch off on their own with a solo technique.

This code associates with the restrictions and policies enforced on wills, depends on, and various other basics legal papers pertinent to estate planning. The Uniform Probate Code can differ by state, but these legislations control different facets of estate planning and probates, such as the creation of the depend on or the lawful legitimacy of wills.

Are you uncertain about what occupation to seek? It is a difficult inquiry, and there is no simple solution. You can make some factors to consider to aid make the choice easier. First, take a seat and detail the important things you are excellent at. What are your strengths? What do you take pleasure in doing? Once you have important link a listing, you can limit your options.

It entails making a decision just how your properties will be distributed and that will certainly manage your experiences if you can no much longer do so yourself. Estate preparation is an essential part of financial planning and must be made with the assistance of a qualified professional. There are several factors to consider when estate preparation, including your age, health, monetary circumstance, and household situation.

The smart Trick of Estate Planning Attorney That Nobody is Talking About

If you are young and have couple of properties, you may not need to do much estate preparation. Health: It is a crucial factor to take into consideration when estate planning.

If you are married, you have to think about how your assets will be dispersed between your partner and your successors. It aims to make certain that your possessions are distributed the method you want them to be after you pass away. It includes taking into account any kind of taxes that might need to be paid on your estate.

Unknown Facts About Estate Planning Attorney

The lawyer also aids the individuals and family members produce a will. A will is a legal file stating how people and households want their assets to be distributed after death. The attorney also aids the people and families with their counts on. A count on is a legal record allowing people and family members to move their possessions to their beneficiaries without probate.

Report this page